Table of Content

There are usually no restrictions on how much may be added to a child’s financial savings account, although you may be restricted to what quantity of transfers out of the account can happen every month. Talking to children about cash can generally result in clean stares. But putting these phrases into action by opening a financial savings account together could additionally be a nice way to advance your child’s financial schooling and encourage good cash habits. While your baby won’t be able to manage their own account, you presumably can teach them about completely different online banking tools. Many banks supply different tools for tracking savings and expenses. When it’s time to start managing cash, they’ll have a good understanding of the place to begin.

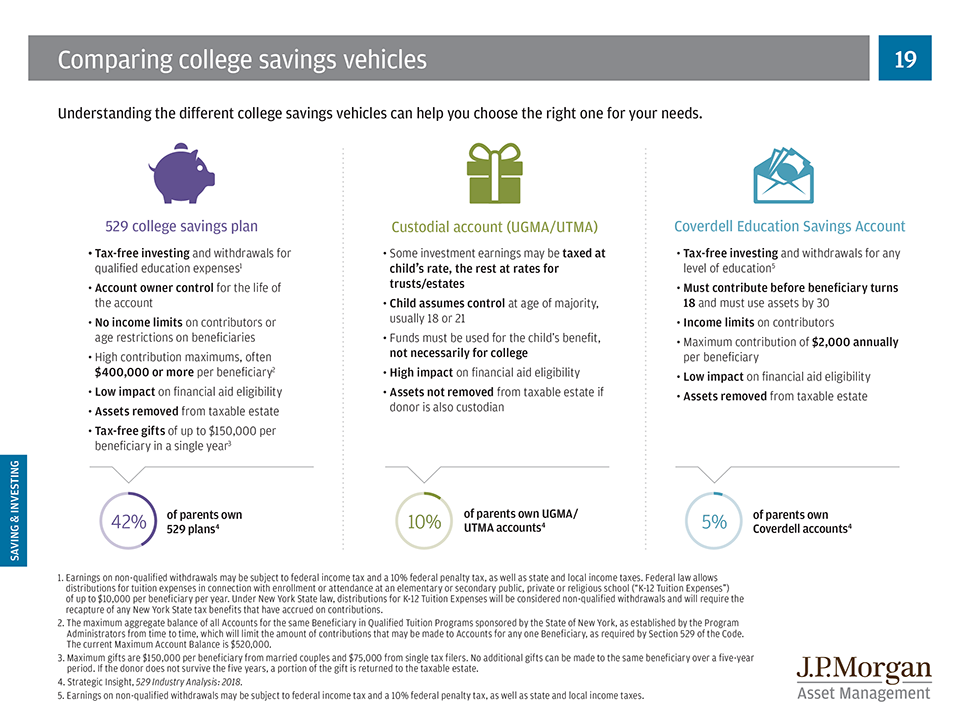

Current efficiency could additionally be decrease or higher than the performance quoted. For efficiency info current to the newest month finish, please contact us. Investing in securities entails dangers, and there's always the potential of losing money whenever you put money into securities. Beneficiaries can't be modified as a end result of contributions into the account are thought of an irrevocable reward.

Ultimate Ideas On Custodial Accounts

Zero account minimums and nil account charges apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest expenses, or other expenses for transactions may still apply. You may also do better really boosting your savings elsewhere, especially with an internet bank. Online banks don’t have to worry about maintaining physical branches. That allows these banks to pass these financial savings onto their customers in the type of high-yield savings accounts and CD rates. That said, you must make certain to suppose via all the options earlier than deciding if a custodial account is best for you.

Loved is our choice for one of the best instructional sources for custodial accounts as a outcome of its mission is to empower kids and families via monetary training and opportunities. A minor's possession of the custodial account could be a double-edged sword. Since the holdings rely as assets, they may scale back a child's monetary aid eligibility after they apply for school. It may also scale back their ability to entry different forms of authorities or neighborhood help. The custodial account you choose will depend upon which advantages you’re searching for your youngster and the fees, minimal balances, and other options that greatest fit your needs.

Make Investments For College Bills

Whether you select to work with an advisor and develop a monetary technique or invest online, J.P. Morgan provides insights, expertise and instruments that will assist you attain your goals. For 2022, the first $1,one hundred fifty of unearned revenue is tax-free, and the next $1,150 is taxed at 10%. However, as soon as the minor reaches the age of majority of their state of residence, they'll file a tax return of their own. At this age, the entire account earnings shall be subject to the beneficiary's tax bracket on the age of submitting.

Greenlight helps children earn money through chores and then teaches them how to manage that money. Vanguard also provides a 529 College Savings Plan for minors – a Nevada plan – available to households in all 50 states. You can withdraw the funds earlier than the age threshold, as long as you employ the cash to learn your child directly. For instance, you may use a few of the money to ship your child to summer season camp, pay for tutoring or contribute towards a primary car. When your child reaches a certain age, you'll find a way to grant her or him account possession.

Jp Morgan On-line Investing

A custodial account could be an efficient savings device, but it’s necessary to understand its pros and cons. Your advisor can help you identify which tool or combination of tools are best for you given your financial circumstances and investment objectives. Highly speculative investments aren’t allowed, however the wider breadth of options makes custodial accounts engaging for some. Savings accounts for kids merely require an grownup to complete the appliance and provide some basic details about the kid who's the minor account proprietor. This usually contains details such because the child’s name, date of birth, and social security quantity. An alternative to a custodial account is just opening a joint savings account along with your youngster.

Fourth, should you give more than $14,000, or $28,000 as a pair, to your child’s custodial account, you’ll be responsible for present taxes on that money. Be conscious of that and be careful to not go over if you don’t should. In most circumstances the custodian of an account goes to be the dad and mom of the minor, but often any authorized grownup could presumably be a custodian of an account for a minor. So in some cases that might imply a grandparent could have a custodial account for a grandchild,and so on. Note that you can buy fractional shares of inventory for as little as $0.01 and all Stash accounts supply funding recommendation when needed. Make sure you converse with an funding advisor well-versed with custodial accounts to find out which one you should open.

Assets in a UGMA/UTMA custodial account are handled as an asset of the beneficiary, which is weighted at 20% towards the Expected Family Contribution method. This is predicated on current interpretation of federal monetary assist rules. Financial assist guidelines might change, and the foundations in impact on the time the beneficiary applies could additionally be totally different. For more full data, please go to the Department of Education's website at Go to third-party website Find your most popular method to invest, whether you are interested in simple inventory trades, mutual funds, ETFs or fastened earnings and bonds.

Just like with adult financial savings accounts, kids financial savings accounts earn interest on the cash deposited into the account based on present rates of interest. Children can earn as much as $2,200 per year in a UTMA account earlier than paying taxes on the cash at their parents’ tax fee. The general rule is that the withdrawals must be for the child’s direct benefit, and a monetary establishment can undertake extra stringent rules. The other sort of custodial account for minors is made potential by the Uniform Transfer to Minors Act . With UTMA accounts, you can assign assets like actual estate, rare art, gold, silver, ownership of copyrights and entertainment royalties to a minor youngster.

A Family Limited Partnership allows family members to personal shares of a household enterprise while securing estate and present tax protections. The account is transferred to the kid once they reach the age of majority, which is both 18 or 21, depending on the state. Any references to 3rd party merchandise, charges, or web sites are topic to vary without discover.

Its long historical past in the business in addition to its low charges is why it wins as our choice for the best custodial account. Charles Schwab is our selection for the most effective general custodial accounts because of its longevity within the industry, its strong customer assist, and its minimal charges. Whatever the amount, custodial account contributions are irrevocable. Once cash goes right into a custodial account, it could't be taken back.

No comments:

Post a Comment